Difference between revisions of "Contribution accounting (Direct Costing and multi-step)"

From ControllingWiki

Achtung. Sie nutzen eine nicht mehr unterstützte Version des Internet Explorer. Es kann zu Darstellungsfehlern kommen. Bitte ziehen Sie einen Wechsel zu einer neueren Version des Internet Explorer in Erwägung oder wechseln Sie zu einer freien Alternative wie Firefox.| [unchecked revision] | [quality revision] |

| (2 intermediate revisions by 2 users not shown) | |||

| Line 7: | Line 7: | ||

Contribution accounting involves the linking of a market-oriented philosophy with economic quantities and values; it leads to a way of thinking that starts with the customer perspective. A well-developed contribution accounting system therefore provides the necessary transparency and shows whether market planning as well as technical and organisational structures are moving collectively towards the profit goal. | Contribution accounting involves the linking of a market-oriented philosophy with economic quantities and values; it leads to a way of thinking that starts with the customer perspective. A well-developed contribution accounting system therefore provides the necessary transparency and shows whether market planning as well as technical and organisational structures are moving collectively towards the profit goal. | ||

| − | |||

<u>Stepwise contribution accounting</u><br> | <u>Stepwise contribution accounting</u><br> | ||

Since structure costs do not alter in direct proportion to the number of items sold or produced, it is not possible to calculate the genuine full costs of any product unit. Consequently, the system of stepwise contribution accounting was developed to improve the possibilities of analysing and controlling costs. | Since structure costs do not alter in direct proportion to the number of items sold or produced, it is not possible to calculate the genuine full costs of any product unit. Consequently, the system of stepwise contribution accounting was developed to improve the possibilities of analysing and controlling costs. | ||

Starting from the CM I, blocks of structure costs are deducted one after another, based on their relationship to the object in question (e.g. product or product group). This multiple calculation of subsequent contribution margins allocates structure costs without applying a key. It is still not possible to see how much a particular item has brought in in terms of profit, but the contribution which an article, a product, or a product group or a range of goods makes towards the covering of the structure costs can be calculated as a figure that can be planned, controlled and for which somebody can be made accountable. | Starting from the CM I, blocks of structure costs are deducted one after another, based on their relationship to the object in question (e.g. product or product group). This multiple calculation of subsequent contribution margins allocates structure costs without applying a key. It is still not possible to see how much a particular item has brought in in terms of profit, but the contribution which an article, a product, or a product group or a range of goods makes towards the covering of the structure costs can be calculated as a figure that can be planned, controlled and for which somebody can be made accountable. | ||

| − | |||

<u>Sales result account</u><br> | <u>Sales result account</u><br> | ||

| Line 27: | Line 25: | ||

[http://www.igc-controlling.org/EN/_publikationen/publikationen.php IGC-Controller-Wörterbuch, International Group of Controlling (Hrsg.), 4. Auflage, Schäffer-Poeschel, Stuttgart, 2010] | [http://www.igc-controlling.org/EN/_publikationen/publikationen.php IGC-Controller-Wörterbuch, International Group of Controlling (Hrsg.), 4. Auflage, Schäffer-Poeschel, Stuttgart, 2010] | ||

| + | |||

| + | [[Category:Planning]] | ||

Latest revision as of 14:05, 4 June 2020

IGC-DEFINITION (abbreviated)

Contribution accounting (Direct Costing and multi-step) / Deckungsbeitragsrechnung (ein- und mehrstufig)

Contribution accounting is the tool for planning and controlling the business’s activities towards the profit objective. Its task is twofold:

- to enable managers to have a better understanding of the effects their decisions are likely to have on profits (decision accounting);

- to convert objectives into figures to provide performance ratings for managers (responsibility accounting).

Contribution accounting involves the linking of a market-oriented philosophy with economic quantities and values; it leads to a way of thinking that starts with the customer perspective. A well-developed contribution accounting system therefore provides the necessary transparency and shows whether market planning as well as technical and organisational structures are moving collectively towards the profit goal.

Stepwise contribution accounting

Since structure costs do not alter in direct proportion to the number of items sold or produced, it is not possible to calculate the genuine full costs of any product unit. Consequently, the system of stepwise contribution accounting was developed to improve the possibilities of analysing and controlling costs.

Starting from the CM I, blocks of structure costs are deducted one after another, based on their relationship to the object in question (e.g. product or product group). This multiple calculation of subsequent contribution margins allocates structure costs without applying a key. It is still not possible to see how much a particular item has brought in in terms of profit, but the contribution which an article, a product, or a product group or a range of goods makes towards the covering of the structure costs can be calculated as a figure that can be planned, controlled and for which somebody can be made accountable.

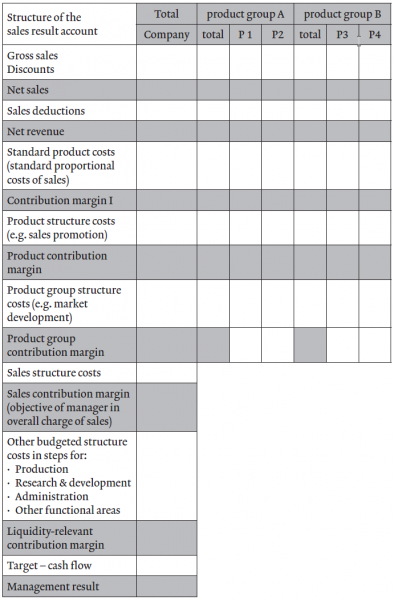

Sales result account

Using the method of stepwise contribution accounting for structuring a sales result account offers many insights for managing and measuring costs and sales performance. The aim of a sales result account is to show the results and the degree of success of one or more sales organisations according to individual sources of profit. For this purpose, all cost factors have to be isolated which cannot be influenced by the sales organization. For this reason, the production costs in the sales result account are always calculated at standard rates, i.e. as planned, then deducted from the net revenue. The structure costs of other functional areas are always deducted as planned values (in budget and actuals).

Therefore any variances between budgeted and actual figures, for which sales is not responsible do not appear in the sales result account, but are shown in the variances résumé.

The number of contribution steps depends on the organisational structure of the business – its areas of responsibility are reflected in the structure of the CM steps. Since multi-dimensional contribution accounting is now more frequent and the structure of the contribution account differs for each company, it is a good idea not just to number the various contributions but also to provide them with descriptive names.

from: IGC-Controller-Wörterbuch, International Group of Controlling (Hrsg.)